When a faculty member at a university has a research project or idea that they’re interested in turning into a startup, some of the first questions that pop to mind involve funding. What funding might be available? Who offers it? And how do you get started?

On-campus funding for startups comes in a variety of flavors, including awards, fellowships and competitions. For example, at UNC-Chapel Hill, campus innovators take advantage of resources like the Office of Technology Commercialization’s Technology Development Grant. They also find early funding traction and support through school-based innovation programs like the medical school’s Center for Health Innovation and those located in the Eshelman School of Pharmacy and Gillings School of Global Public Health. Such programs allow faculty to pursue cutting-edge research and explore ideas that have significant scientific, commercial and social potential.

After new ventures use these earliest funding sources to explore their research and technologies, they quickly need to prove that their ideas will work. In fact, proving the feasibility of their concepts is essential before they can receive large federal grants or private equity investments. At this point, faculty need to develop prototypes, evaluate the market potential, advance their technologies and create sound business plans. This is where a university program like KickStart Venture Services can help.

Part of the UNC Office of Technology Commercialization, KickStart Venture Services supports faculty who want to launch intellectual property (IP)-based startups based on their research at the University. For instance, through its KickStart Commercialization Awards initiative, the program helps early-stage companies meet commercial milestones from a technical or business perspective.

“As we work to accelerate innovation and positively impact our communities, it’s imperative that we provide the right support at the right time to UNC faculty startups,” says Judith Cone, vice chancellor for innovation, entrepreneurship and economic development. “The KickStart Commercialization Awards program provides crucial assistance for startups – bridging funding gap challenges that can make or break early ventures.”

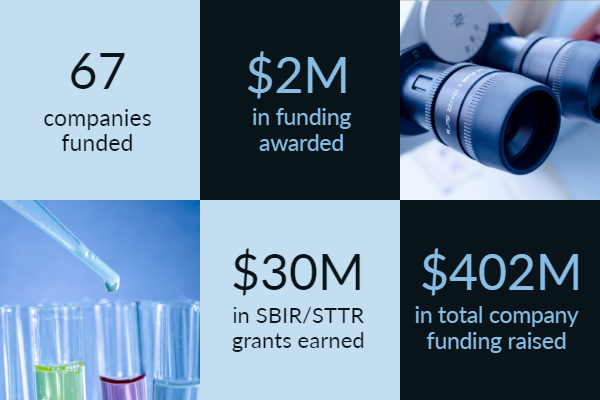

Since its inception, the KickStart Commercialization Awards program has provided more than $2 million in funding to 67 companies, including Cell Microsystems, G1 Therapeutics and Spyryx. In addition, the KickStart program has worked with more than 100 companies, providing advice, mentorship, incorporation, management and funding.

The return for the companies can be substantial. For instance, G1 Therapeutics, a clinical-stage oncology company in RTP and the first UNC-affiliated company to receive KickStart award in 2008, captured more than $108 million in an initial public offering of its stock during 2017. In total, companies that have received funding or services from KickStart have moved on to win $30 million in SBIR and STTR federal grant funding, ultimately raising more than $402 million in total funding.

“Our interactive, collaborative process helps startups identify and focus on what steps are needed to propel them to become more attractive to funders,” says Rose. “From government grants to angel and venture capital investors, we help startups find the best match for their funding needs.”

Helping startups advance toward larger funding opportunities means that KickStart has to keep an eye on the changing needs of startups and shifting industry trends. Being attuned to the evolving landscape helps KickStart adapt its award program to provide the greatest benefit to the companies that receive it. For example, traditionally, the program focused exclusively on the life science industry. Recently, however, Rose and team have expanded the award to include additional focus areas, which netted participation by a diverse set of promising startups:

Sandbar Oyster Company is commercializing a novel biodegradable composite material designed to restore oyster habitats, reverse the decline in oyster populations, protect the shoreline and revitalize the oyster industry as part of the coastal marketplace. Sandbar was founded by Niels Lindquist, professor at the UNC Institute of Marine Science, and commercial fisherman David “Clammerhead” Cessna.

Premirr Plastics has developed a catalyst system for recycling PET plastic, commonly found in water bottles and other commercial products, in an eco-friendly manner. The company was co-founded by Matthew Parrott and J. Chris Luft, both former professors at UNC-Chapel Hill.

EmpowerRT is a new, social enterprise startup with a mission to help people in developing countries by improving cancer radiation therapy without spending millions of dollars on modern treatment technology. EmpowerRT was founded by Sha Chang, a professor in the Depart of Radiation Oncology at the UNC School of Medicine.

Beyond the KickStart program and early awards available on campus, the University’s Carolina Angel Network and Carolina Research Ventures Fund are often next steps.

Launched in November 2016, the Carolina Angel Network is designed to help close the early-stage funding gap by investing in startup companies founded by alumni, parents, staff, faculty and students. It includes a $2 million sidecar fund exercised by the University to amplify investments beyond what the angels invest themselves.

While it’s not unusual for a university like UNC-Chapel Hill to establish its own angel network, the Carolina Angel Network is unique because it works as part of a four-university consortium called the Triangle Venture Alliance (UNC-Chapel Hill, Duke University, NC State University and NC Central University). Like UNC-Chapel Hill, these other universities have their own angel networks, but the four universities also partner through a collaborative investment framework that allows them to team on investment deals of mutual interest. This regional, cross-university investment arrangement is distinctive to the university startup system in North Carolina and ultimately provides greater support for the highest-potential startups in the region.

Lending an even further level of support, in 2016 the state of North Carolina approved a $60 million Venture Multiplier Fund, which allocated $4 million to support Triangle Venture Alliance deals involving UNC-Chapel Hill, NC State, Duke and NC Central.

Another investment program that provides critical support to UNC-Chapel Hill ventures in the Carolina Research Ventures Fund (CRVF), which unlocks the potential of young companies focused on University research. This $10 million fund was established in 2016 and is managed by venture capital firm Hatteras Venture Partners. Its goal is to help research-based startups at UNC get their products into the hands of businesses and consumers by providing early capital and tapping into the University’s relationships with the national venture capital community. Early results are impressive. CRVF has invested in six startups that have raised more than $312 million in funding and include two company exits.

This article is part two in a three-part series that explores the funding landscape for startups founded by university faculty. Read part one and part three.